|

In reaching out to several personal financial "personalities" to learn more, I've been shocked at how many are willing to sit and chat! So, I am recording these conversations to share on YouTube. Check them out here!! First up, the Basics of Budgeting with the Budget Teacher, a pre-inventory before you budget, and speaking with Dan and Scott from Teach and Retire Rich podcast / 403bwise (nonprofit and active - and VERY HELPFUL - Facebook community) . Join me on this - yet another new journey!

Subscribe and hit the bell notification to stay up to date!

0 Comments

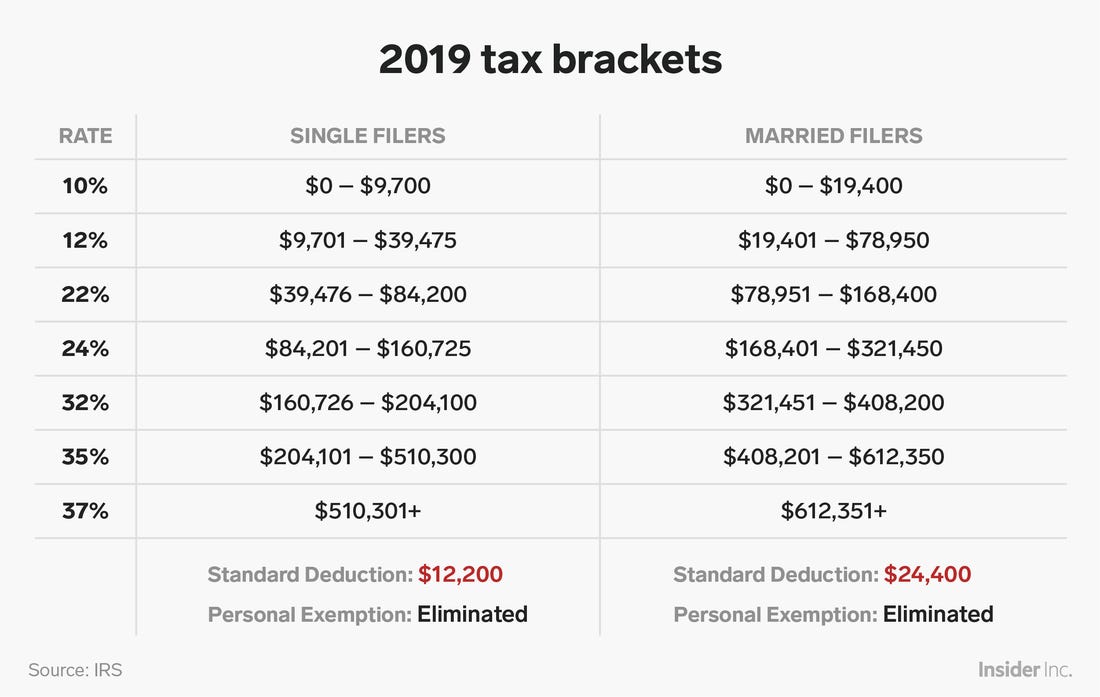

I now know there are a variety of methods and strategies to invest. That is part of what has created analysis paralysis in so many educators in schools. In addition to IRAs, which everyone has access to, educators (and other state employees) have access to two special options that sound like just a bunch of arbitrary numbers - the 457 and the 403b. Great, more options, right? But. these are tax advantaged accounts, similar to the more commonly heard of 401k. If you have a part of your salary deducted and immediately placed into these accounts, that PART of your salary can be non-taxable (for now)! I had to look into tax rates to try to get a better understanding of this. so let me give you the summarized version. Tax brackets show you the tax rate you will pay on each portion of your income. I'm married, so I'll use the "married" example. So, as a married person (filing jointly), If we earned $19,000, the tax rate of 10% would be applied to our entire income. But, if we together made $50,000, what would happen? Income from $0-19,400 would be taxed at 10%. Income from $19,401 to our $50,000 would then be taxed at 12%.

What makes tax advantaged accounts, like the 401k (at most companies), 403b, 457, cool is that money is legally "hidden" as far as taxes are concerned. If we earned $50,000, but put $30,600 into tax advantaged accounts, it will look like we only earned $19,400! And all that money is still ours, but saved for our future selves. Obviously, you'd have to budget and figure how much you need to live on now and how much you'll need to live on later to see what would work best in your situation. Besides being tax advantaged, I can tell you that a 403b is a nonprofit version of a 401k. It grows tax free, but you will pay taxes whenever you do eventually pull money out. There are limits to how much you can put in to this kind of account. In 2020, the max you can put in is $19,500. If you take money out of these accounts before retirement age though, you'd incur extremely high fees. MOST 403b accounts are tricky and expensive! They charge hidden, very expensive fees. They also employ very friendly salespeople to lure you in with free food to your own teacher's lounge. So, in general, if you are using am annuity product or anything with the idea of "insurance" in the name - IT'S A TRICK - RUN! There are a handful of FANTASTIC, low fee, self directed options though that if you can find, you should get involved with ASAP. In my research so far, it looks like Vanguard, Fidelity, T. Rowe, and Aspire are GREAT options. Definitely do a bit of research to figure out what you're most comfortable with. A great place to research the options is 403bwise.org and 403bcompare.com. 457s are unique to state employees and generally are very similar to 403bs. Often, states have their own 457/deferred compensation plans. They also have that $19,500 limit, BUT AS AN EDUCATOR, YOU CAN FILL BOTH the 457 and the 403b, granting you $39,000 in tax advantaged (hidden) money! 457s are unique also because you may be able to access this money BEFORE retirement age IF you leave your district. This means you could accept a job at a new district, start putting money into THEIR 457 account, and start withdrawing money from the previous district's account! Certain people (see the Millionaire Educator) have made mixed their financial planning with a little game theory to spin this money in magical ways. You can read up on his journey here. In trying to learn more about these things, I've reached out to several people in the field who have agreed to speak to me. I will follow up in August with information from these zoom sessions. So, I went down the YouTube rabbit hole after watching Brad Finn's video and reading up on Grumpus' sites about pensions. I learned that there's a movement called FI(RE) - Financial Independence, Retire Early. The main idea is that many people (most younger than myself) have been saving/investing HUGE amounts of their income and living frugally with the goal of being completely independent. They can quit their formal work and live frugally on their savings. This challenges so many of our societal norms. But, I'm intrigued.

I've been reading on the topic. A LOT. (As an Amazon Associate I earn from qualifying purchases. If you were going to buy any of these anyways, I appreciate you using my links!) My favorite book on the topic so far was "Quit Like a Millionaire: No Gimmicks, Luck, or Trust Fund Required" by Kristy Shen and Bryce Leung*. Second to that, "Playing with FIRE" by Scott Rieckens. I watched his documentary on FIRE after reading his book. (As usual - I prefer the book!) Another I've enjoyed is "The Simple Path to Wealth" by JL Collins. Currently, I'm reading "YOUR MONEY OR YOUR LIFE" by JL Collins. However, a lot of my reading has not been in books alone, but in popular blogs in the FIRE community. Mr. Money Mustache, JL Collins, the Millionaire Educator**, and *the Millennial Revolution (authors of "Quit Like a Millionaire"). I've also been listening to as many podcasts as possible. I found **The Millionaire Educator on ChooseFI. My mindset has been forever altered. This man has brought the teaching and financial independence game to level 100. I then searched for all podcasts he's been featured on (further down this rabbit hole...) and found my new favorite - "Teach and Retire Rich" by Teacher Dan Otter, Ph.D. and Certified Financial Planner Scott Dauenhauer. These two also have a website and a very helpful Facebook community. Through their podcasts, website, and Facebook group, my next goal emerged. I need to understand what the heck "457b" and "403b" mean. I work in NY state schools, so I am required to fund the NYSTRS. I am Tier 5, so I naturally went to the most easily accessible and reliable resource (besides the NYSTRS website) - YOUTUBE! The hidden gem (for ME) was a video by Brad Finn - another NYS educator. He explained HIS retirement, though he is Tier 6.

In our house, we've taken the stand that we are DONE WITH DEBT. We have been using Dave Ramsey's baby steps to attack our debt with a vengeance. We've gotten rid of some student loans, a bank loan, credit cards, and now have a paid off car. If you are looking for motivation, the Dave Ramsey podcast is free. He has written several best selling books that are available at the library.

I'm an educator in the public school system in America. I'm a Speech-Language Pathologist, currently in a middle school. I help kids learn how to use and understand language, correctly make speech sounds, interact and understand social rules, and learn strategies for speech fluency.

However, like the rest of the world, I'm stuck at home. If I'm being honest, the home learning programs we're trying in my district are NOT super effective for my students. In my frustration of teaching my own kids at home and trying to provide therapy online, I'm struggling mentally. I want to aim for something positive in the time away from the normal I once knew. So, I'm deciding to begin my own learning journey. Since I've been in the public schools, I've gotten dozens of email "invitations" to meet with financial planners who want to "help" me get a plan for my retirement. It always feels sleazy, sales-ey and honestly - unclear. 403b? 457b? IRA? What are all these arbitrary letters and numbers? Surrender fees? Other fees listed as percentages? So, I did nothing. I'm 36 and only know that I have a mandatory pension and pennies in a 401k (MORE letters!) from a previous (before I was in schools) job. So, I am deciding to dig in. I need to be the lifelong learner I'm called to be. Welcome on the journey with me, the Penny Pinching Pathologist. |

AuthorJoin me, the Penny Pinching Pathologist, on a journey of financial discovery. How can we educate ourselves on financial fluency for school workers and other governmental employees? Archives

August 2020

Categories |

RSS Feed

RSS Feed